1. Definition

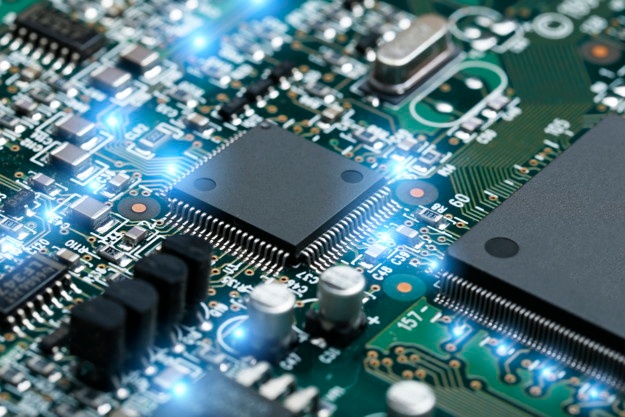

Electronic components are discrete elements with specific functions used in electrical circuits or electronic devices. They are the basic components that can operate independently or combine to form more complex circuits. Electronic components include types such as resistors, capacitors, diodes, transistors, and many others, each with its own function.

Electronic components play a crucial role in the fields of technology and electronics, from sophisticated devices like mobile phones and computers to simpler applications such as lighting and household appliances. The development and application of these components significantly affect the features and performance of modern electronic devices.

2. Legal Documents Related to Importing Electronic Components

Part II, Appendix I of Decree 187/2013/ND-CP lists items prohibited from import, including used electronic devices and information technology products.

Article 2 of Circular 18/2014/TT-BTTTT stipulates that high-tech radio transmission and reception devices must be newly manufactured and have circulation permits. However, some components and spare parts of certain electronic devices do not require import permits.

Section b, Clause 2, Article 3 of Circular 31/2015/TT-BTTTT states that components, component assemblies, and spare parts of certain used information technology products must also be restricted from import.

Decree No. 43/2017/ND-CP dated April 14, 2017, regulates the content, labeling, and management of goods labels circulating in Vietnam, including electronic component labels.

3. Import Documentation for Electronic Components

The import documentation for electronic components is similar to that of other normal imported goods. The regulations regarding documentation during the import process are specified in Circular 38/2015/TT-BTC dated March 25, 2015, and amended by Circular 39/2018/TT-BTC dated April 20, 2018.

The necessary documents in the import dossier include:

-

Customs declaration

-

Sales contract

-

Commercial invoice

-

Packing list

-

Bill of lading

-

Arrival notice

-

Certificate of origin (if applicable)

-

Other supplementary documents (such as catalogs, etc.) as required by customs authorities

Among the required documents, the customs declaration, commercial invoice, and bill of lading are mandatory and very important documents that businesses need to prepare carefully. Other documents may be requested depending on specific circumstances as determined by customs authorities.

Ensuring that all documents in the import dossier are complete and accurate is extremely important to avoid risks such as delays in customs clearance, which can affect the import schedule. In particular, important documents like the bill of lading and certificate of origin should be sent in advance via express delivery services to ensure they arrive on time and avoid unnecessary container or storage fees.

4. Procedure for Importing Electronic Components

The procedure for importing electronic components, along with other types of goods, is detailed in Circular 38/2015/TT-BTC dated March 25, 2015, amended and supplemented by Circular 39/2018/TT-BTC dated April 20, 2018. Below is the basic procedure that you can refer to when declaring customs and clearing a shipment of electronic components.

Step 1: Prepare and Declare Customs

First, you need to prepare all necessary documents such as the sales contract, commercial invoice, packing list, bill of lading, certificate of origin, and arrival notice. Then, determine the HS code for the electronic components and enter all information into the customs system via the ECUSS5 electronic customs declaration software.

This declaration process requires the importer to have in-depth knowledge of the procedures and skills to input information into the declaration form. If you are not familiar with these procedures, seeking customs brokerage services or professional shipping companies is a safe option to avoid mistakes that could waste time and money.

Step 2: Submit the Declaration and Process the Channeling

After completing the declaration, the customs system will channel the declaration into Green, Yellow, or Red lanes. You need to print the declaration and submit the import dossier at the corresponding customs office. Depending on the channeling results, the next process may vary:

-

Green Lane: Customs clearance proceeds normally without detailed checks.

-

Yellow Lane: Customs requires a document check before clearance.

-

Red Lane: Physical inspection of goods before clearance.